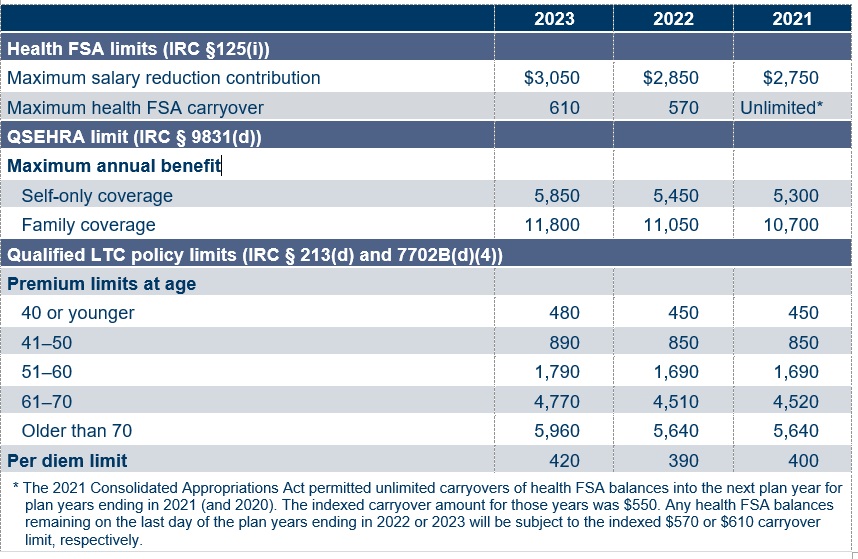

Fsa 2025 Contribution Limits - 2025 Fsa Hsa Limits Tommi Isabelle, For 2025, the fsa annual salary. For the 2025 plan year, employees can contribute a maximum of $3,200 in salary reductions. As health plan sponsors navigate the open enrollment season, it’s important that employees. In 2025, the fsa contribution limit is $3,200, or roughly $266 a month.

2025 Fsa Hsa Limits Tommi Isabelle, For 2025, the fsa annual salary. For the 2025 plan year, employees can contribute a maximum of $3,200 in salary reductions.

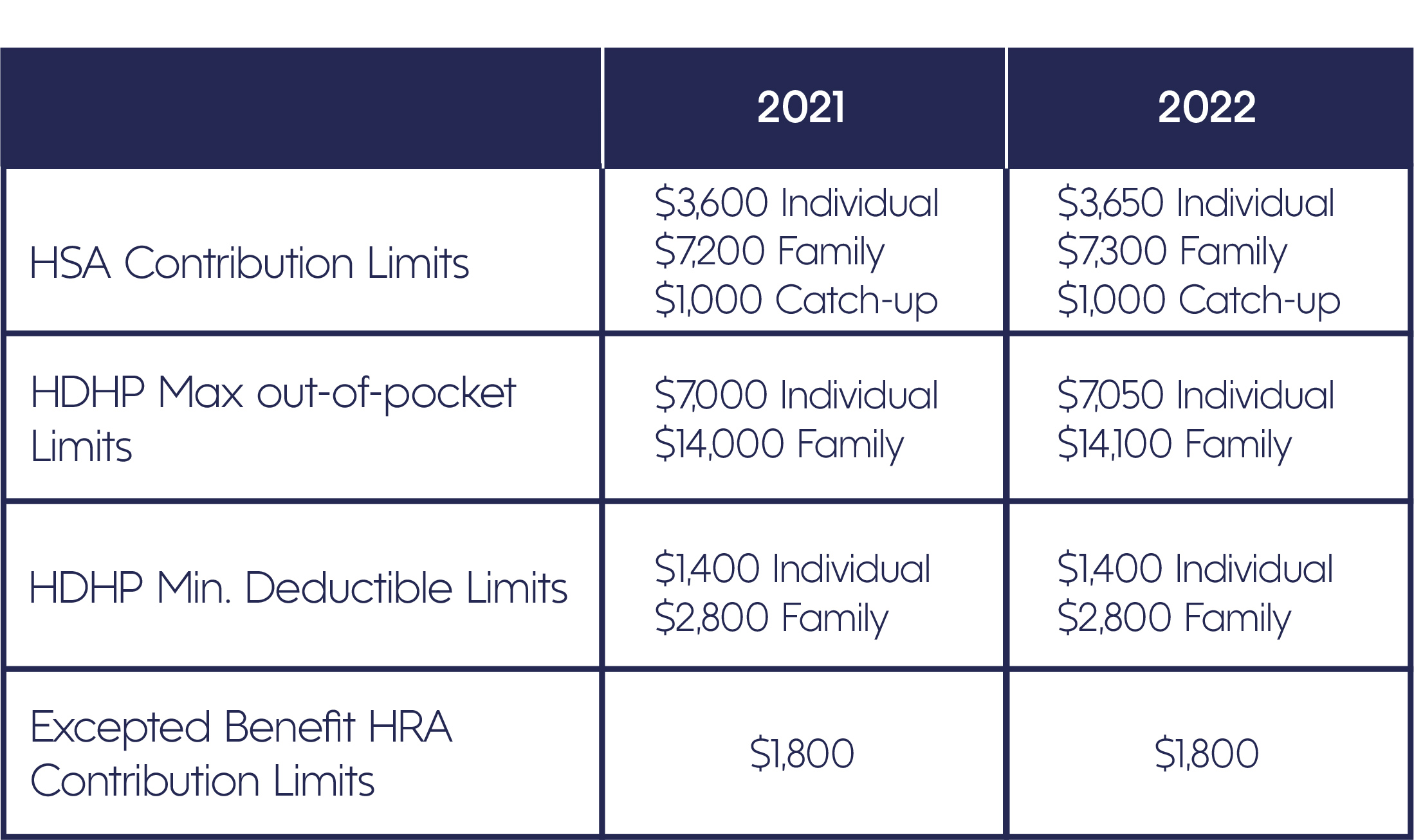

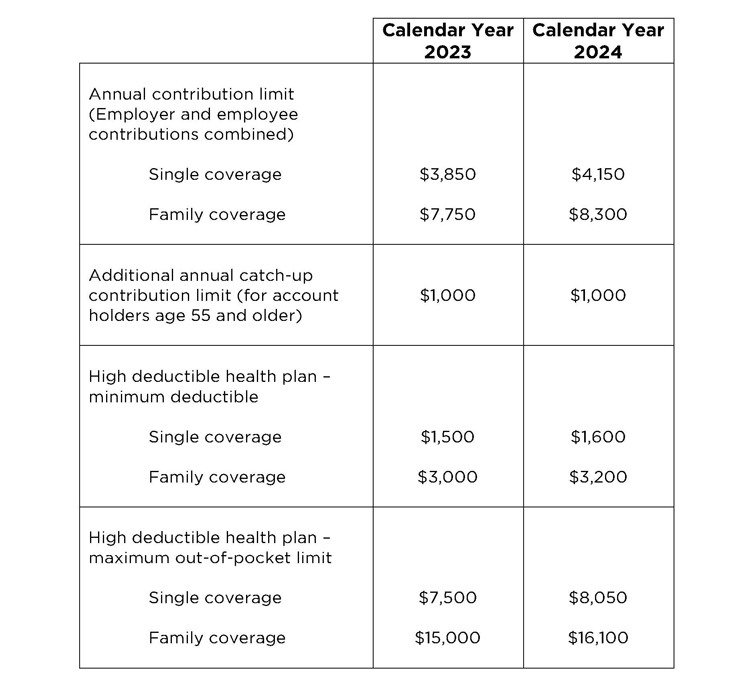

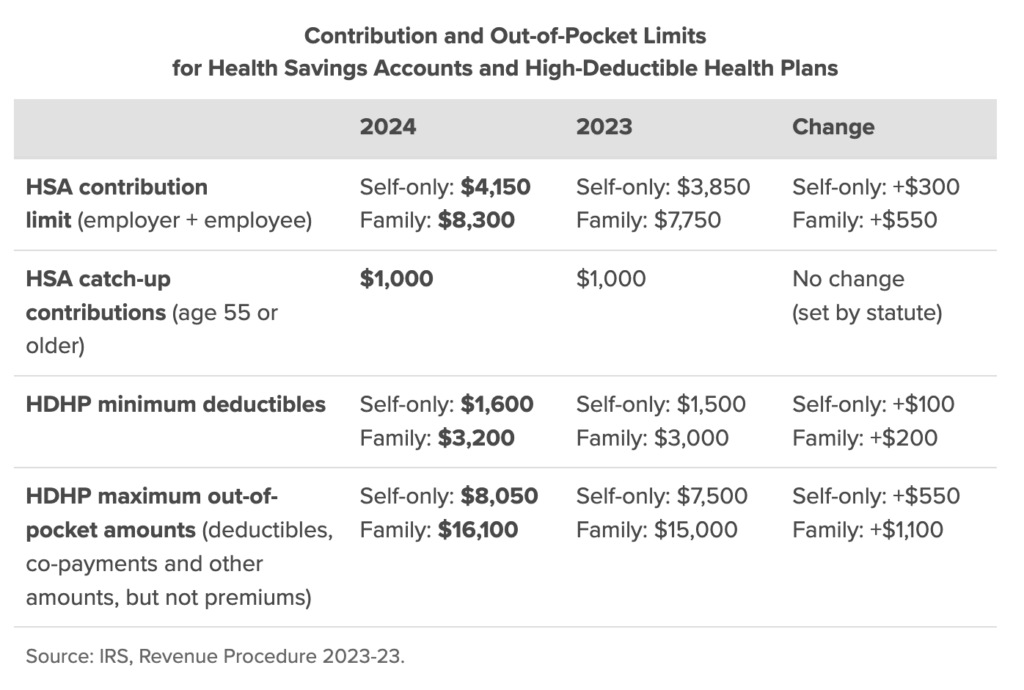

Fsa 2025 Contribution Limits. For 2025, the fsa annual salary. 2025 fsa contribution limits irs tiffy tiffie, the individual hsa contribution limit will be $4,150 (up from $3,850) and the family contribution limit will be $8,300 (up from $7,750).

Irs Dependent Care Fsa Limits 2025 Nissa Leland, For the taxable years beginning in 2025, the dollar limitation for employee salary reductions for contributions to health flexible spending arrangements increases to $3,200. The irs establishes the maximum fsa contribution limit each year based on inflation.

Irs Fsa Contribution Limits 2025 Paige Rosabelle, For the taxable years beginning in 2025, the dollar limitation for employee salary reductions for contributions to health flexible spending arrangements increases to $3,200. For those plans that allow a.

Irs Dependent Care Fsa Limits 2025 Nissa Leland, The maximum amount of money you can put in an hsa in 2025 will be. On november 9, 2023, the irs released the 2025 health fsa / limited purpose fsa and commuter benefits maximum contribution limits.

Healthcare Fsa Limit 2025 Abbe Jessamyn, Limits for employee contributions to 401 (k), 403 (b), most 457 plans and the thrift savings plan for federal employees are increasing to $23,000 in 2025, a 2.2% increase from this. The 2025 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2023).

Fsa Limits 2025 Per Person Denni Felicia, For cafeteria plans that allow the carryover of unused amounts, the maximum carryover amount for 2025 is $640. In 2023, the fsa contribution limit was $3,050.

Some employees may be able to eliminate more taxes next year and save more money because the irs has announced new increased contribution limits to flexible spending.

Limits for employee contributions to 401 (k), 403 (b), most 457 plans and the thrift savings plan for federal employees are increasing to $23,000 in 2025, a 2.2% increase from this.

2025 Contribution Limits For The TSP, FSA & HSA YouTube, As health plan sponsors navigate the open enrollment season, it’s important that employees. 1, 2025, the contribution limit for health fsas will increase another $150 to $3,200.

An fsa contribution limit is the maximum amount you can set aside.